When Shai Gilgeous-Alexander recently finalized a four-year supermax extension, he didn`t just cap off an extraordinary season with a massive new contract. The reigning MVP and Finals MVP also approached an unprecedented financial milestone.

By the 2030-31 season, the final year of Gilgeous-Alexander`s new agreement, his projected earnings are $79 million. This equates to over $963,000 per game, putting him on the cusp of the NBA`s first contract worth a million dollars per contest.

While Gilgeous-Alexander may not quite reach that specific figure with this deal, the league`s top earners are undeniably becoming even wealthier. The concept of a professional athlete earning a million dollars per year was once front-page news, as it was when MLB pitcher Nolan Ryan achieved this feat in 1979.

Let`s delve into the factors propelling the NBA`s next financial frontier, examine the likely candidates to break the $1 million per game barrier, and consider the wider implications for star salaries and the league itself.

The Driving Forces Behind Skyrocketing Superstar Paychecks

The upper echelon of NBA salaries has surged dramatically due to two primary drivers: the introduction of the supermax extension (officially known as the `designated veteran extension`) and a rapidly ascending salary cap.

Established in the 2017 collective bargaining agreement, the supermax tier allows players with 7-8 years of service, who have remained with their original team and met specific performance criteria (like All-NBA selections or MVP awards), to sign extensions starting at 35% of the salary cap. Gilgeous-Alexander is the 14th player to sign such a deal.

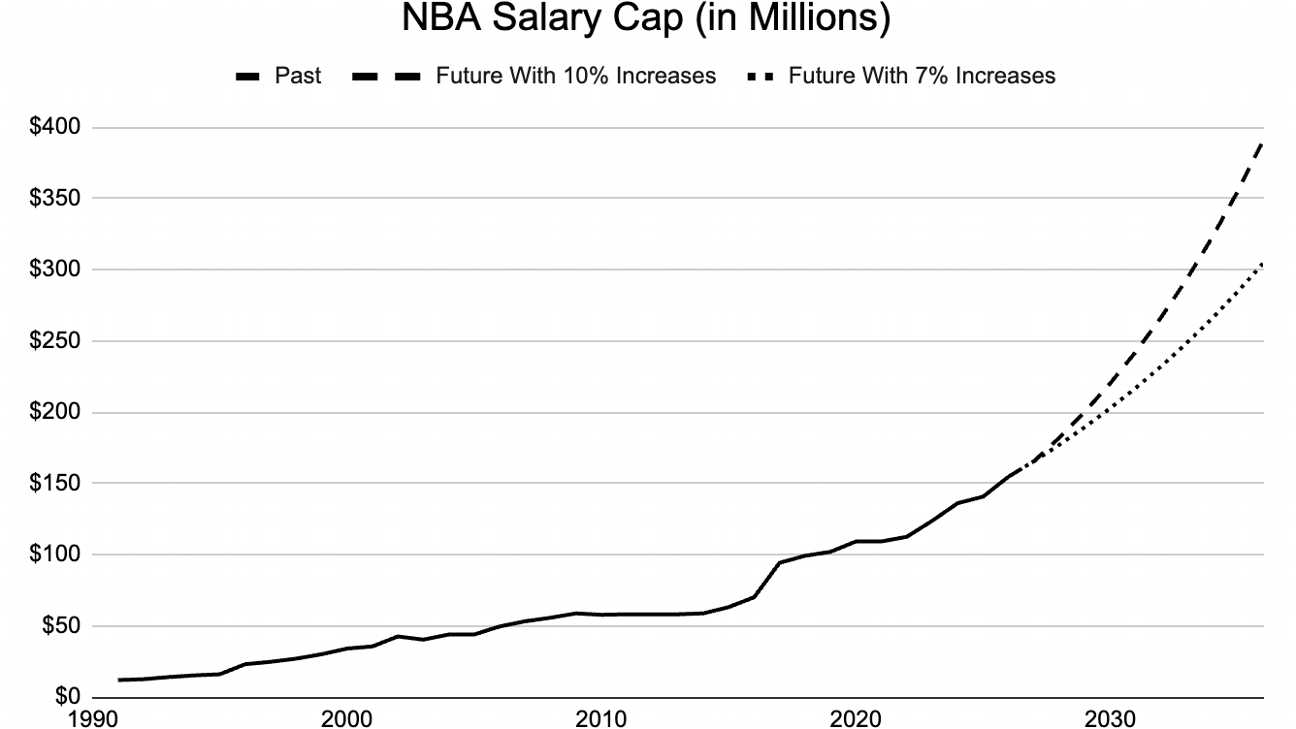

These supermax contracts are becoming increasingly lucrative due to `basketball inflation,` which significantly outpaces general economic inflation. A decade ago, the salary cap was $63 million, roughly $85 million in today`s dollars adjusted for national inflation. However, the actual 2024-25 salary cap is $141 million – a two-thirds increase compared to that inflation-adjusted expectation.

These converging trends have pushed the league`s highest salaries faster and higher than ever before. This trend is set to accelerate further with the league`s new television rights agreement taking effect next season, injecting a massive amount of new revenue.

Last summer, the NBA and its media partners finalized an 11-year deal valued at $76 billion, averaging nearly $7 billion annually. In contrast, the previous TV deal, which concluded after the 2024-25 Finals, was worth $24 billion over nine years, averaging about $2.7 billion per season.

Effectively, the new national broadcast agreement will generate approximately 2.6 times the per-season revenue of its predecessor for the NBA.

This substantial influx of cash will have a profound impact on the salary cap and, consequently, on supermax contract values. The last time the NBA saw a significant increase in national TV revenue, the salary cap jumped by 34% in a single offseason, enabling teams like the Golden State Warriors to sign Kevin Durant. To mitigate such dramatic spikes, the current CBA includes `cap smoothing` provisions, limiting annual salary cap increases to a maximum of 10%.

Indeed, the salary cap is projected to rise by 10% next season, directly increasing the supermax starting salary by the same percentage. However, the NBA projects a 7% increase for the 2026-27 season, partly due to reduced local television revenue from issues with regional sports networks.

While not as abrupt as a 34% leap, consecutive 7% or 10% increases will have a similar cumulative effect league-wide over several years. As an illustration: The salary cap will exceed $150 million for the first time next season, but could potentially double to over $300 million by the 2033-34 season. This demonstrates the power of compound growth.

The resultant impact on supermax salaries is striking. When Stephen Curry became the first player to sign a supermax for the 2017-18 season, the cap was $99 million, meaning his contract started at $34.7 million (35%).

It took five years for the supermax value to climb above $40 million. But as the salary cap accelerated, the pace quickened: three more years to pass $50 million, a projected two more years to reach $60 million, and only one additional projected year to exceed $70 million.

Higher initial salaries also lead to larger annual raises throughout a supermax deal. The following tables project the starting and ending salaries for upcoming classes of four-year supermaxes, assuming annual cap increases after 2026-27.

Table 1: Projected supermax salaries with 10% annual cap increases (after 2026-27)

| Starting Season | In Year 1 (Millions USD) | By Year 4 (Millions USD) |

|---|---|---|

| 2026-27 | $57.9 | $71.8 |

| 2027-28 | $63.7 | $79.0 |

| 2028-29 | $70.1 | $86.9 |

| 2029-30 | $77.1 | $95.6 |

| 2030-31 | $84.8 | $105.1 |

| 2031-32 | $93.3 | $115.7 |

| 2032-33 | $102.6 | $127.2 |

Table 2: Projected supermax salaries with 7% annual cap increases (after 2026-27)

| Starting Season | In Year 1 (Millions USD) | By Year 4 (Millions USD) |

|---|---|---|

| 2026-27 | $57.9 | $71.8 |

| 2027-28 | $62.0 | $76.8 |

| 2028-29 | $66.3 | $82.2 |

| 2029-30 | $70.9 | $88.0 |

| 2030-31 | $75.9 | $94.1 |

| 2031-32 | $81.2 | $100.7 |

| 2032-33 | $86.9 | $107.8 |

Note: These projections assume the supermax structure remains unchanged after the current CBA and vary based on potential future cap growth rates.

Identifying Candidates for the $1 Million Per Game Threshold

Based on these projections, the most likely candidates to first reach $1 million per game earnings are players who will sign supermax deals after Shai Gilgeous-Alexander, who was part of the 2018 draft class.

From the 2019 draft class, Ja Morant is the only player with an All-NBA selection (three years ago). It appears improbable that any player from this class will now qualify for a supermax extension.

However, the 2020 draft class presents two prime candidates for supermax eligibility: Anthony Edwards and Tyrese Haliburton. Haliburton`s status is uncertain following an Achilles injury that will sideline him for the entire next season. But Edwards has earned consecutive All-NBA Second Team honors, positioning him favorably to sign a supermax in the summer of 2027. This contract could be worth up to four years and $345 million, potentially surpassing the $82 million annual mark in its second season.

If Edwards doesn`t reach it first, two players from the 2021 draft class made their debut on the All-NBA teams last season: Cade Cunningham and Evan Mobley. Other promising players from that draft include Scottie Barnes, Alperen Sengun, and Franz Wagner.

Assuming even modest annual cap increases over the coming years, it is highly probable that whichever player among Cunningham, Mobley, and their draft contemporaries qualifies for the supermax will earn more than $1 million per game at some point during their contract.

As the salary cap continues its ascent, more and more young players will have the opportunity to earn unprecedented sums on the basketball court. Recent draftees, including Jalen Williams, Chet Holmgren, and Paolo Banchero from the 2022 class, and Victor Wembanyama and Amen Thompson from the 2023 class, could realistically sign contracts exceeding $100 million per year.

Experienced veterans signing shorter extensions could also achieve nine-figure annual earnings – including Gilgeous-Alexander himself, when he signs his next lucrative extension after his current supermax concludes in 2031. Just recently, Devin Booker of the Phoenix Suns agreed to a new two-year extension valued at up to $145 million, which carries a higher average annual value than SGA`s recently signed supermax (though its shorter duration means it won`t reach the same peak annual figure as SGA`s contract by its end).

NBA Following Trends in Other Sports

While a player earning a million dollars per game is unprecedented in basketball, other professional sports have already seen athletes surpass this figure.

In the early 2020s, Major League Baseball pitchers like Gerrit Cole and Justin Verlander began earning over $35 million per season. For a starting pitcher making roughly 32 starts, this exceeds $1 million per outing. This comparison offers a useful parallel for the NBA. Advanced statistical models estimate that the NBA`s best players contribute around 20 wins per season, roughly equivalent to one win every four games. Similarly, top baseball pitchers are valued at about eight wins above replacement per year, matching that one-in-four ratio.

Although the comparison isn`t perfect, the most impactful NBA players have a similar level of influence on winning a single game as an elite MLB pitcher does from the mound, making it logical that their salaries would trend similarly.

Other leagues compensate their players even more generously on a per-game basis. In the NFL, 84 players have cap hits of $17 million or higher this season, according to Spotrac, meaning they earn at least $1 million per game over a 17-game schedule. The league`s premier quarterbacks approach $3 million per game – which aligns with their outsized impact on game outcomes and the higher stakes of each game in the league`s shorter season and its status as the wealthiest sports league in the country.

The highest earners globally are elite soccer players recruited by the Saudi Pro League with exorbitant contracts. Cristiano Ronaldo is reportedly earning around $200 million annually.

However, among traditional team sports not funded by sovereign wealth funds, the NBA stands out with its unique combination of high per-game pay and volume. MLB pitchers and NFL stars play significantly fewer games than their NBA counterparts. Consequently, even if their per-game earnings are higher in some cases, their total annual compensation is still substantially lower than that of the NBA`s supermax elite.

Consider this statistic: Next season, 15 NBA players have cap hits of $50 million or more, according to Spotrac. The NFL, NHL, and MLB combined currently have only two such contracts: New York Mets outfielder Juan Soto and Dallas Cowboys quarterback Dak Prescott.

Potential Ripple Effects of a Soaring Salary Cap

As superstar salaries climb, several potential ripple effects could manifest in the NBA. Load management, for instance, could face increased scrutiny and reduced tolerance when players earning such enormous sums miss games. The criticism might be: “You`re making over a million dollars tonight, and you`re not even playing?!”

Higher salaries might also influence player decision-making. Some NBA stars could begin prioritizing factors other than maximum compensation when making career choices. While competitive athletes naturally desire the maximum contract as a status symbol and for financial security, as the numbers become astronomically large, is there a tangible difference in quality of life between earning $75 million per year versus $85 million?

If the financial difference becomes less impactful at these extreme levels, stars might be more inclined to test the free agency market rather than automatically re-signing with the team that can offer the supermax, knowing they will secure multi-generational wealth regardless. Others might choose to sign for less than the maximum allowable amount to help their team manage the salary cap, particularly to accommodate teammates who might otherwise exceed the punitive second apron.

Finally, even if player salaries maintain a constant percentage of the salary cap, the sheer magnitude of the numbers could provoke new discussions about whether NBA stars are excessively compensated. However, here`s the crucial point: Shai Gilgeous-Alexander`s value, based on objective metrics, already exceeds nine figures annually, even before his contract reaches its peak.

Are Superstars Worth $1 Million Per Game?

Last season, NBA teams collectively spent $5.65 billion on salaries and luxury tax payments, according to Spotrac data. With 1,230 regular-season wins available, this averages out to approximately $4.6 million per win. (While there`s a detailed debate about accounting for minimum salaries and replacement levels to determine the `true` cost of a win, this simple calculation provides a reasonable baseline. Including those factors would likely make stars appear even *more* valuable, not less.)

Multiplying that per-win cost by Gilgeous-Alexander`s league-leading estimated value of 20.9 wins, according to Dunks & Threes, yields $96 million in regular-season value alone. This calculation doesn`t even account for SGA leading his team to the championship, increasing his franchise`s ticket and merchandise sales, or boosting the Oklahoma City Thunder`s overall value.

For context, when LeBron James rejoined the Cleveland Cavaliers in 2014, Forbes estimated that he “immediately elevate[d] the Cavaliers franchise value by at least $100 million to $150 million.” That figure would undoubtedly be higher today after another decade of inflation and league growth.

Given the presence of contract maximums and the significant influence of stars in the NBA relative to other sports, the league`s best players have historically signed contracts that represent a discount relative to their on-court production. This will likely remain true even at $1 million per game or more. In 2016, ESPN`s Kevin Pelton calculated that, considering all factors, “in a world without limits on player salaries, the Cavaliers could easily justify offering James $100 million a year.”

As Pelton noted, $100 million was more than the entire salary cap at the time, similar to how Michael Jordan`s salary exceeded the Chicago Bulls` total cap in the late 1990s before max contracts were implemented. Applying the same valuation logic in 2025 would place the value of top stars north of $150 million annually – nearly *double* the $1 million per game threshold.

This isn`t true for every player on a max contract; in a zero-sum salary environment, some players will inevitably exceed their contract value while others fall short. However, for the truly franchise-defining, league-altering players – the modern-day equivalents of LeBron James, Michael Jordan, or Shai Gilgeous-Alexander – the conclusion is clear.

A supermax salary reaching $1 million per game will not only be a significant milestone when it`s finally achieved in the coming years. Based on their actual economic impact and on-court value, it will still represent a considerable bargain for the team employing them.